AMG Advanced Metallurgical Group N.V. Update

The last weeks of March were quite intense at AMG, first with the announcement of the acquisition of a 25% stake in Zinnwald Lithium PLC, and later with the Capital Markets Day focused on AMG Lithium.

Zinnwald Lithium PLC 25% Stake Acquisiton

On March 23rd, AMG acquired a 25.13% stake in Zinnwald Lithium PLC (LON: ZNWD) via the subscription of 118,996,738 newly issued shares for a total subscription amount of 12.4M. The net proceeds from the fundraising will be used to advance the Zinnwald Lithium Project in Germany towards a value optimised bankable feasibility study (BFS) for lithium hydroxide and towards the continued exploration of the potential to expand the size and scope of the project.

The Zinnwald Lithium Project

The Zinnwald Lithium Project expects to supply 12 ktpa of battery grade lithium hidroxide during more than 35 years. Its location in a mining area in the German-Czech border is one of its greatest advantages: firstly, it’s well connected and there’s posibility to use existing infrastructure; secondly, it’s very close to the future battery gigafactories projected to be built in Europe; lastly, it’s less than 150 km away from AMG’s future lithium hydroxide refinery in Bitterfeld.

The potential to sell by-products (mainly SOP fertiliser) coupled with the jobs and economic activity it would bring to an economically challenged region almost guarantees that the authorities will greenlight the project.

Timeline of the project

The project timeline is in a quite advanced stage and it could be the first lithium mine to open in the EU. This completely aligns with the goal of AMG to develop a lithium supply chain in Europe, which is also the goal of EU politicians who don’t want to rely on third countries for their energy supply.

As in any lithium project, there are still hurdles in the way but if everything goes smoothly the construction could start in late 2024 and the production two years later. The dreaded environmental study should not be a problem because it’s an underground mine which uses existing infrastructure, so the environmental impact would be minimal.

Economics of the project

From a financial point of view, the Zinnwald project looks very solid. The payback period will be just 3.3 years, with a post-tax Net Present Value of $1012M at 8% discount. Annual EBITDA would reach $192M including by-products, which is a great return on a $336.5M initial investment.

The Cinovec Lithium Project

At the other side of the German-Czech border there’s another lithium project that could drastically change how Zinnwald is developed. In fact, it’s the same lithium deposit that extends in both countries: the German part (1/3 of the total deposit) is owned by Zinnwald Lithium PLC, and the Czech part (2/3 of the total deposit) is jointly owned by the Czech government controlled utility ČEZ Group (51%) and an Australian junior miner called European Metals (ASX:EMH) (49%).

This opens up 3 different scenarios to follow:

Develop the each part of the deposit individually.

Develop both at the same time.

Start first the German part, integrate the Czech part later.

It’s not clear yet which alternative will be used; AMG management has stated that they have a clear preference for one of them but they will have to persuade the rest of the shareholders as they don’t have control over the whole company.

Exploration Rights

Zinnwald Lithium also possess several exploration rights (Sadisdorf, Falkenhain and Altenberg) around the Zinnwald which are still in an early phase of the exploration.

Capital Markets Day

On March 30th, AMG hosted its CMD focused on AMG Lithium. No big/unexpected announcements where made but it was nice to learn more about the lithium strategy for the next few years.

Upstream - Technical Grade Lithium Plant in Brazil

The first part of the presentation was focused in the upstream business, giving out some more details about the future of AMG Brazil. Once the spodumene production increase from 90 ktpa to 130 ktpa is just a couple of months away, the next investment will be a technichal-grade lithium carbonate plant in the Mibra mine.

This technical grade lithium plant is just a precursor plant to transform the spodumene into technical-grade lithium carbonate to later send it to the hydroxide refinery in Germany, where it will be transformed into battery-grade lithium hydroxide.

The plant is expected to be ready in 2026 once the current long-term spodumene contracts are over, thus integrating the whole lithium value chain from the spodumene extraction in Brazil to the refinery in Germany (more on that later). The investment for the project is expected to be in the $250M area and it will have a capacity of 16.5 ktpa.

Management also shared the current exploration projects in Brazil, where they plan to open a new mine before 2030. It’s still very early to know if some of these projects will be successful but it’s good to know that they are working on it.

Downstream - Bitterfeld Lithium Hydroxide Refinery

Later the presentation shifted to the downstream business, where AMG is expected to open the first module of the lithium hydroxide refinery at the end of this year.

The long-term strategy is to use the lithium carbonate from the technical grade lithium plant in Brazil (2026), transform it into battery-grade lithium hydroxide and then sell it to the cathode producers or use it in the Solid-State pilot plant.

Until 2026, AMG has reached an agreement with a chinese tolling partner (General Lithium) to transform 10 ktpa of spodumene from the Mibra mine (available because the first of the spodumene contracts expires in 2024) into technical-grade lithium hydroxide in 2024 and 2025 while the lithium carbonate plant is being constructed in Brazil.

Until 2026 AMG will have to purchase technical-grade lithium hydroxide in the market to feed the refinery. The timeline for the first module can be summed up like this:

Late 2023 - commissioning, first purchases of technichal-grade lithium hydroxide

2024 - the first long-term spodumene contract expires, so 10 kt of technical-grade lithium hydroxide will be available (via chinese tolling), 5 kt more will come from purchases.

2025 - same as 2024 but the purchases will reach 6.5kt, an offtake agreement with an unknown third party will kick in (3.5kt) so it will the first year to reach full capacity (20 kt).

2026 and subsequent years - the second spodumene contract expires and the lithium precursor plant in Brazil will be ready (16.5 kt lithium carbonate), thus the first module will be fully feed by the Mibra mine (16.5 kt) and the offtake agreement (3.5 kt) with the third party.

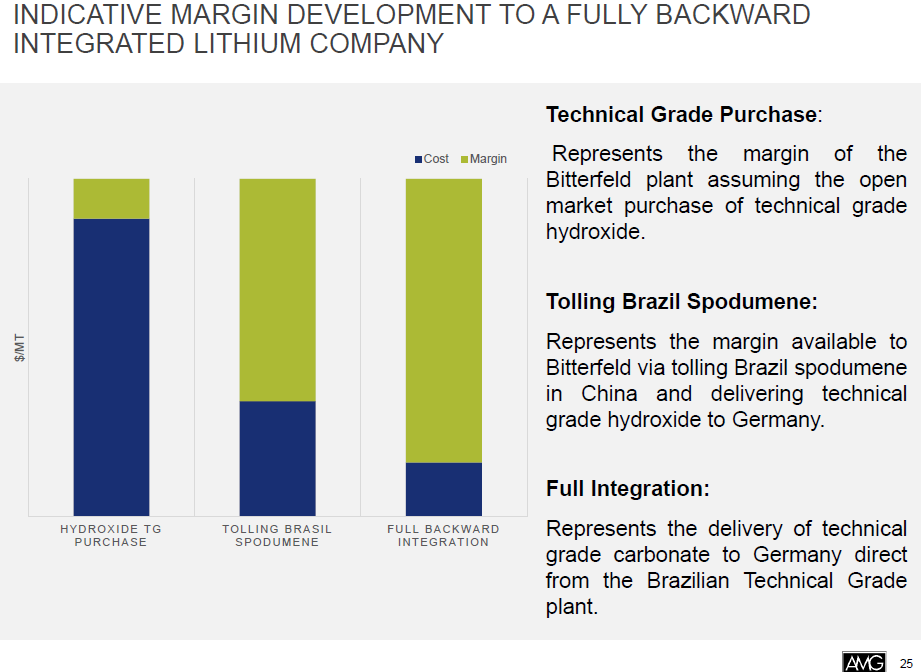

The margin in the refinery business greatly varies depending on the source of the lithium: at the beginning the plant will be much less profitable (around $60M in EBITDA) but it will improve in 2025 and will achieve cruising speed in 2026.

When full integration is ready in 2026 the first module of the refinery would add up to $1B in sales and $200M in EBITDA. The plan is to open 4 more modules in the next years, making it possible to reach $5B in sales from the refinery.

Solid State Battery

AMG shared also its ambitions for the next generation of batteries which will transform the market in the next years, the all-solid-state-battery (ASSB). Unlike the current lithium-ion or lithium polymer batteries which use liquid or polymer gel electrolytes, the ASSB uses solid electrodes and a solid electrolyte. Also, the precursor used for the ASSB is lithium sulfide instead of the current lithium hydroxide.

The roadmap shared by management implies that at the end of the decade a commercial plant could be ready. I take it as an ambition of AMG more than a guidance: no concrete dates, investment requirements or revenue/EBITDA estimates were given.

LIVA Battery

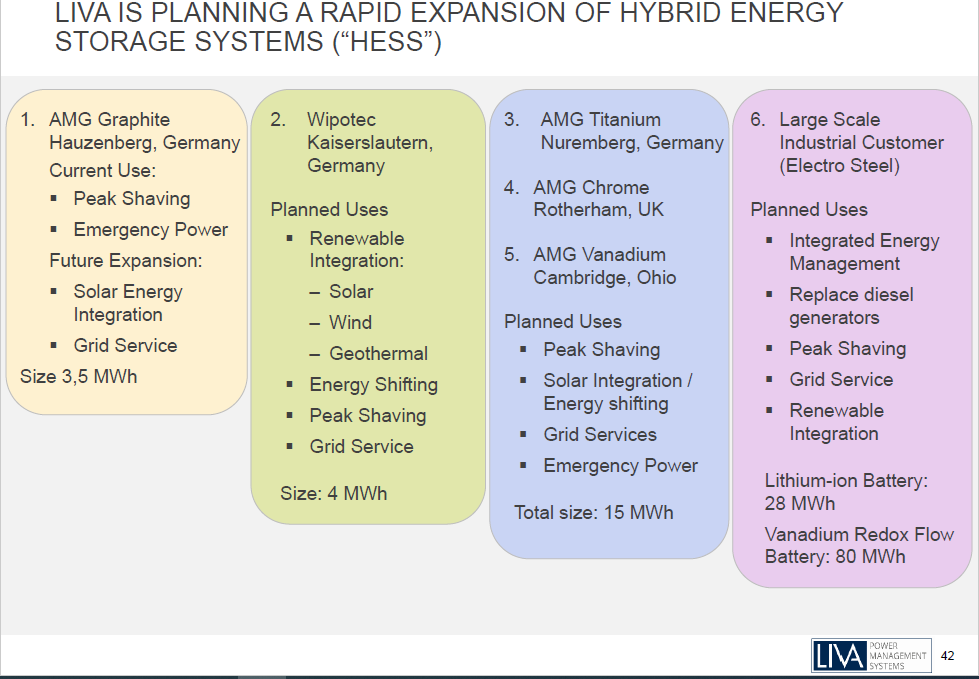

The last part of the presentation was centered around the LIVA battery, a hybrid energy storage system based on a lithium-ion battery and a vanadium redox flow battery. Since the beginning of the year AMG has announced several projects to install LIVA batteries, both in-house and with third parties.

The future of the LIVA battery looks bright, especially in a time of high energy prices and decarbonatisation. As always, no financials or guidance were shared about the LIVA battery, so we must wait more to be able to determine its potential.

Q&A

No intention to acquire 100% of Zinnwald Lithium - CEO Heinz Schimmelbusch said that it hasn’t crossed their minds to make a bid for the whole company.

The Zinnwald-Cinovec Lithium deposit could feed 1-2 modules in the Bitterfeld refinery.

The expected EBITDA from transforming technical-grade lithium hydroxide into battery-grade lithium hydroxide is around $3,000 per ton - that’s why they guide for at least $60M of EBITDA for the first module (20 kt x $3,000 per ton). That could improve to $200M once full integration is achieved.

Q1 2023 is going to be quite strong.

Conclusion

Firstly, I think the Zinnwald Lithium operation looks quite sensible due to the small price paid plus the key fact of getting a foothold in the European Union next to the future refinery. I wouldn’t rule out an increase of the 25% stake in the subsequent equity raise if they are sure that the project could be successful. The big question is which path they will follow to develop the project; I personally think that AMG prefers to jointly develop the whole deposit to be able to guarantee a higher amount of lithium for the refinery.

About the CMD, we can see that AMG is working into achieving the desired integration between its upstream and downstream lithium businesses. Let’s see how the next 2-3 years develop because they are going to be key for the future of the company. I also like the fact that they are working in long.term projects like the ASSB and the LIVA battery, although I would prefer that they could share some financials about those projects and give some guidance.