I’m sure you’ve already heard it. Fossil fuels are dead. Renewables are the future. Although 2022 has completely destroyed this theory, there’s no doubt that companies around the world are stepping up its efforts to ditch fossil fuels and ride the green wave. Billions are being spent by companies to comply with CO2 emission rules or to achieve carbon netural status, all mixed with a bit of virtue signaling to please politicians and the woke crowd.

As a consequence of this frenzy, companies are rushing to secure the supply of the materials needed to make the green transition possible, sending the prices of several metals like lithium or copper to the moon.

Following this price increase in raw materials, companies in the lithium mining sector are booming. For example, Albermale Corporation (NYSE: ALB) has gone up more than 400% since March 2020 while Pilbara Minerals (ASX: PLS) has gone up 20 times in the same time frame. European Lithium (ASX: EUR), which owns just a small lithium mine project in Austria, has a valuation over €120M.

But there’s a company in the sector that hasn’t joined the party yet.

Amstedam-listed AMG Advanced Metallurgical Group N.V. (AMS: AMG) is flying completely under the radar, not even included in the Global X Lithium & Battery Tech ETF (LIT). While competitors are attracting headlines and its prices are exploding, AMG is just followed by a handful of local analysts in Dutch investments banks, trading under 8 times 2022 expected earnings.

Moreover, AMG has many expansion projects which will be completed in the near future that will transform the company into the potential European leader in the sector and some catalysts to drive its valuation more in line with the rest of its peers.

I know you must be thinking “How is that possible? A company in a high growth sector with such a low multiple? With many expansion projects underway? What’s the catch?”

I will try to answer these questions, expounding why I think AMG can be a great investment for this decade, a rare opportunity to catch a multi-bagger.

Understanding AMG

AMG is a Dutch company that produces highly engineered specialty metals and mineral products and provides related vacuum furnace systems. Its goal is to produce materials for infrastructure and energy storage solutions while reducing the CO2 footprint of both its suppliers and its customers.

Currently AMG is divided in 3 different areas (Q3 2022 EBITDA = $102.6M)

1 - Clean Energy Materials (around 82% of Total Ebitda) - this area includes Lithium, Vanadium and Tantalum.

2 - Critical Materials (around 7% of Total Ebitda) - mineral processing operations in Antimony, Graphite and Silicon metal.

3 - Critical Materials Technologies (Around 11% of Total Ebitda) - combines vacuum furnace technology with high-purity materials, serving mainly the aerospace sector.

The EBITDA break down by business unit reflects very clearly that Clean Energy Materials amounts to the vast majority of the company earnings. To better understand it its necessary to take a deeper dive into its two main drivers, AMG Lithium and to a lesser extent AMG Vanadium, where the present and the future of the company relies.

AMG Lithium

Since 2018 AMG Lithium operates the Mibra Spodumene mine in Minas Gerais (Brazil), whose estimated remaining life is around 17 years, until 2039.

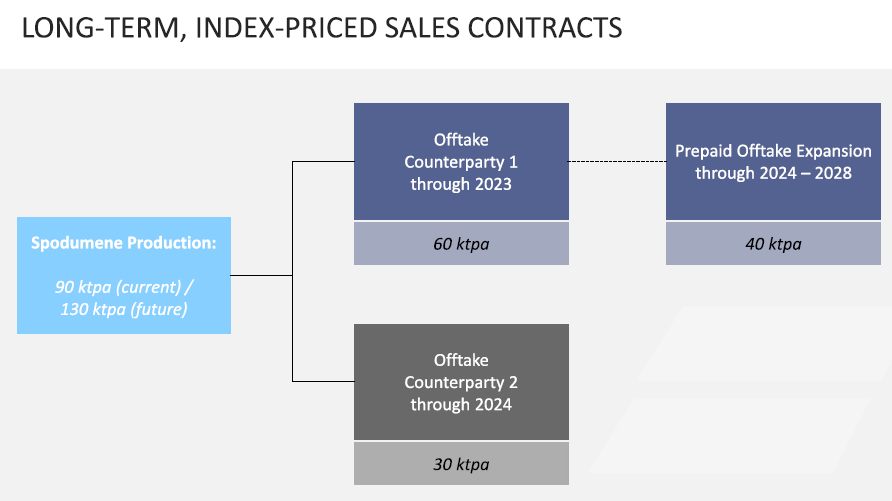

AMG Lithium extracts spodumene (a mineral consisting of lithium) and sells it to two unknown Asian customers via long-term offtake agreements. The future spodumene expansion project (more info on this expansion later) is already sold to one of the existing customers.

The current spodumene production of 90,000 tons per annum (90 ktpa) at current prices translates into an EBITDA of around $280M. In Q3 2022, AMG Lithium made up over 70% of the total EBITDA of AMG.

AMG Vanadium

Headquartered in Ohio (USA), AMG Vanadium is the largest recycler of spent catalyst in the world and the largest ferrovanadium producer in North America. It converts spent refinery catalyst and other vanadium bearing residues into ferrovanadium and a ferronickel-molybdenum alloy, which are marketed and sold to the carbon and stainless-steel industries.

Due to new sulfur emission standards by the International Maritime Organization, since 2020 refineries must upgrade their “bottom of the barrel” crude to reduce emissions, so this is a huge tailwind for their business.

AMG Vanadium has recently expanded its operations in Ohio with a new facility in Zanesville that will allow them to double its prior volume. This new facility will help AMG Vanadium to reach around $100M EBITDA per year.

There are also plans to expand internationally outside of the US (more details later).

Organizational Structure Shift

The obvious first problem that we encounter in AMG relates to its organizational structure. AMG covers very different businesses with very different growth prospects and margins, which greatly difficults its valuation. Making things worse, AMG Lithium, its jewell crown, is buried inside the Clean Energy Materials division, so it is impossible to know exactly its revenue, margins or net income.

That’s about to change.

Management is currently working to turn AMG Lithium into a standalone company under standalone management, starting January 1st 2023. The goal is to make AMG Lithium stand out, so a proper valuation of the business is possible. Furthermore, it will help to think about AMG mainly as a lithium play instead of an array of businesses all mixed together with little in common.

This organizational shift will also allow an “apples to apples” comparison with its competitors which trade at much higher multiples, making a re-rating of the stock much more likely.

Expansion Projects

Good news is AMG is not sitting idle in its mine just focused on spodumene extraction; instead AMG is determined to build an electric vehicle battery materials value-chain in Europe.

These expansion projects will transform AMG Lithium from a pure lithium mining company to a vertically integrated battery provider for the European automobile industry.

In the next 5 years these projects will take place:

1 - Mibra Spodumene Mine expansion, from 90 ktpa to 130 ktpa (under construction, comissioning expected in Q1 2023) - The spodumene plant in Brazil is being expanded by 40 ktpa. After the expansion, at current spodumene prices, it would generate around $100M in EBITDA per quarter, $400M per year.

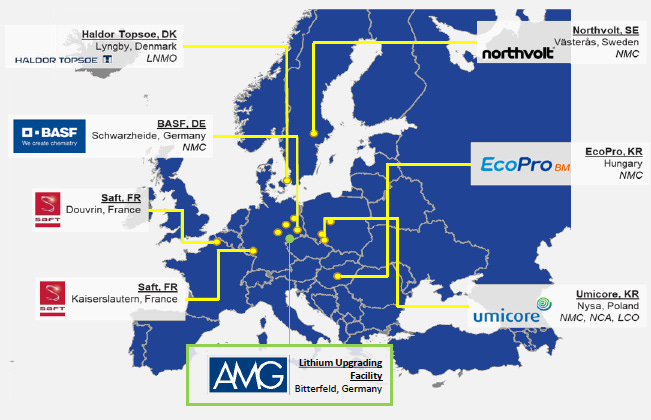

2 - First European Battery-grade Lithium Hydroxide plant (under construction, start up in Q3 2023) - Located in Germany, the first module of up to five in the future will be able to produce 20 ktpa of battery-grade lithium hydroxide.

According to management in the last earnings call, EBITDA is somewhere between $3,000-$10,000 per ton, so that would add up to $60M-$200M EBITDA per module per year. Expected CAPEX of $140M for the first module, $75M per additional module.

90% of the capacity of the first module is already under MOUs; the only known customer right now is EcoPro in Hungary. The plant location in the heart of Europe gives them easy access to the many cathode producing plants that are planned in the area.

Being the first European battery-grade lithium hydroxide producer will give them a huge first mover advantage because right now China completely dominates the lithium refining market. AMG will be a more convenient supplier for these surrounding companies and will help establish the much needed European energy independence

3 - Tecnical Grade Lithium Precursor Plant (basic engeneering underway, commissioning expected late 2025) - Located in Brazil, this plant will transform the spodumene from the Mibra mine into a lithium precursor material that will be transported to the lithium hidroxide Plant in Germany. Its commissioning is expected when the current spodumene agreements are finished. According to the management team, this plant will translate into a financial benefit of $16M per year.

4 - Future commercial Solid Electolyte Plant (construcition and commissioning dates unknown) - The last step down the value chain will be to build a Solid Electrolyte Plant to complete the vertical integration. Dates are still unknow but it’s expected to be up and running later in the decade (2027-2028).

5 - Lithium-Vanadium (LIVA) Battery - AMG has developed a LIVA battery for industrial power management to reduce CO2 emissions and energy costs. It’s been recently deployed at AMG Graphite’s Hauzenberg facility to flatten production-driven spikes in electricity demand. The financials and potential future applications of the battery are still unknown.

6 - Shell & AMG Recycling B.V. (SARBV) - AMG Vanadium has entered into a Joint Venture (50/50) with Shell to develop a Metal Reclamation and Catalyst Manufacturing center in Saudi Arabia. The $140M CAPEX investment for this project (70M each) is expected to be recovered in just 4 years. More info in this presentation.

Valuation

Entering December 2022, AMG is trading at €37.08 (closing December 5th) which translates into a valuation around €1,200M and an Enterprise Value of €1600M. It implies a 2023 P/E ratio of 6.6 and a 2023 EV/EBITDA ratio of 4.25. These multiples could be accurate for an old mining company but they don’t reflect the future potential of company that can be the European leader in a high growth sector.

For valuation purposes I will use 2023 forward estimates because I think it does better reflect the current reality of the company (AMG Vanadium Zanesville expansion completed, Mibra mine expansion commissioning in Q1 2023 and the first module of the Lithium Hidroxide Plant commissioning in Q3 2023).

The following back-of-the-envelope calculations reflect where the share should be trading today. As AMG completes its expansion projects and the financials improve in the subsequent years, the valuation of the company would follow suit.

EV/EBITDA Valuation

Management has guided for at least $400M EBITDA for 2023, which I think is quite a conservative estimate. Let’s use instead the analyst consensus of $421M which could be closer to reality.

Let’s assume AMG Lithium EBITDA reaches €280M, which equals the $70M EBITDA in Q3 2022 annualized for the year. It’s quite a conservative aproach taking into account the expansion projects but lithium prices could go down from current levels. Applying a 10x multiple to this line of business, similar to its peers, would give us an EV of $2,800M.

For the remaining $140M in EBITDA from the rest of the business lines, a much more conservative multiple of 5 seems right, to arrive to an EV of $700M.

Total EV = $2,800M (AMG Lithium) + $700M (rest of the business lines) = $3500M

Debt is quite contained at $370M (mainly from a 5% $300M municipal bond maturing in 2049; rest is bank debt)

Market Capitalization = $3500M (EV) - $370M (Debt) = $3130M

Stock Price = $3130M (Market Cap) / 31.88M (shares outstanding) = $98.18/share = €93.55

Upside Potential = 152.29%

P/E Ratio Valuation

For a Price-to-earnings valuation I rely on the 2023 EPS GAAP estimates from analysts. Applying a multiple of 10 (same as Albemarle) to the $6.59 EPS 2023 analyst consensus we get a $65.59/share = €62.50 target price.

Upside Potential = 68.55%

Discounted Cash Flow Valuation

As much as I like a DCF valuation model I don’t think its appropiate to apply to AMG at this moment due to the lack of visibility of the business into the future. The next 5 years are going to change the company completely so it’s next to impossible to estimate CFs that far into the future.

Potential Catalysts

What does a deeply undervalued company, in a high-growth sector, with multiple expansion projects underway need to make its share price surge? Gain attention. AMG is still a big unknown in need to be recognized by the wider public. The AMG Lithium carve-out and the expansion plans will help but there are several catalysts that could speed-up the process.

1 - AMG Lithium IPO - In the last Capital Markets Day back in January 2022 the management team talked about a potential IPO for AMG Lithium in order to fund the additional investments needed in the business. Since then the idea has seemed to cool off because the high lithium prices might allow AMG to self-fund all the expansion projects.

2 - Strategic Partner in AMG Lithium - Another strategic alternative presented in the CMD was to sell a minority stake in AMG Lithium to a third party. No more details have been given in the last earnings calls.

3 - AMG Critical Materials Technologies IPO - Pre-COVID management plan was to IPO this business into a separate company, but plans were scrapped due to its exposure to the struggling aerospace sector. An IPO could be back in the table when the aerospace sector fully recovers.

4 - Takeover Bid - Due to the difficulty and the high cost to secure a supply of lithium, battery or automobile companies could decide to move up the value chain. For example, Elon Musk has hinted that Tesla might enter into the lithium mining and refining business.

5 - Index Inclusion - Sooner rather than later AMG will be included in most green energy ETFs reaching new investors that otherwise wouldn’t have invested in it.

6 - EU Propaganda - One of the main consequences of the Ukranian War and the subsequent Russian sanctions has been to properly grasp the importance of energy independence. The EU is betting heavily in the energy transition (European Green Deal), so I expect the Lithium Hydroxide plant opening next year in Germany to be a milestone hailed by politicians and the press.

Company Risks

As any other company, AMG has some company specific risks that have to be aknowledged.

1 - Lithium Prices - The sky high Lithium prices that miners have enjoyed this year will not last forever. I think prices could easily drop 30% to a more sensible level in the ST/MT. In the LT the market is forecasted to keep a supply deficit because this decade demand is expected to grow much faster than supply, so a LT price crash is quite unlikely.

2 - Brazil Political Risk - Lula victory in the last Presidential Election in Brasil over Bolsonaro raises some concerns about a potential nacionalization of the lithium sector, following the steps of some left-wing politicians in LATAM like Evo Morales. While you cannot 100% dismiss it, I think a nacionalization is highly unlikely to take place if we look at his previous presidential term where he followed left-wing policies but not radical ones.

Conclusion

AMG Advanced Metallurgical Group N.V. is evolving into the first European vertically integrated lithium miner and refiner but the market still prices the company as an old mining company with no growth prospects, mainly due to its complex organizational structure and its lack of public recognition.

Management is ready to solve these issues, thanks to the AMG Lithium carve-out and the expansion projects for the next years which will completely transform the company.

Deeply undervalued in comparison to its peers, AMG has the potential to turn into a multi-bagger this decade as lithium demand rises.

Additional Material

The following presentations are great resources to learn more about AMG.