Summary

TeamViewer SE is a €1.5B German software company specialised in providing remote connectivity solutions worldwide.

Most of its revenues come from its stagnant SME division; on the other hand its smaller Entreprise division aimed at multinatonal companies is growing at 20%.

High EBITDA margins (around 43%) common to SaaS models and high cash conversion rates (80% of EBITDA).

Last month the company announced the acquisition of 1E, a Digital Employee Experice (DEX) company that will transform TeamViewer platform offering a more complete package.

Stock price near all-time lows trading at 8x 2024e FCF.

Management has been aggresively buying back stock in the last years.

Introduction

As we all know, Europe is falling behind in tech giants against the US and China. Apart from a handful of winners like ASML, Adyen, or SAP, most people couldn’t name a single technology company from Europe. But that doesn’t mean that they don’t exist.

One of them is TeamViewer SE (ETR: TMV). It is by far the leader in the remote-support market with a share over 50%, a category that is expected to keep growing in the coming years. But the market just doesn’t care at all about it.

While everything is not perfect for the company (its larger division is barely growing, management has made some mistakes in the way) it has many positive aspects, like very high margins, a constant growth of its total addressable market, augmented reality technology and an upcoming acquisition that will completely transform its main software platform. All this trading below 8x FCF.

Is TeamViewer going to be able to change its route and become relevant again?

Decoding TeamViewer SE

The History

TeamViewer has a very curious inception. It was first launched as a software in 2005 by a German firm called Rossmanith GmbH to reduce travel time to their customers by remotely accessing their computers. The software was such a success that they decided to carve it out to form its own company, TeamViewer GmbH.

In 2010 it was acquired by GFI Software, a Malta-based company centered around security software; in 2014 they sold it to private equity firm Permira.

The company IPOed in September 2019 with a valuation of €5.25B at €26.25 per share, just in time to benefit from COVID pandemic. It was one of the winners of the “work from home” trend thanks to the lockdowns, surpassing the €10B valuation mark in June 2020 trading at a whopping 100x earnings.

As it usually happens when times are good, the company squandered some hard earned Euros on first-rate sponsorship deals: it entered a five year agreement (£47.5 million a year!!!) with Premier League club Manchester United (luckily the scope of the deal was reduced after just two seasons and it will end in 2025) and another 5-year agreement with Mercedes AMG F1 Team, which is still in place.

But the good years were not to last.

Once the lockdowns were lifted and people returned to work, TeamViewer has been struggling with revenue growth in its main division. Despite that, it is well positioned to benefit from current megatrends in the workplace like hybrid work, increasing automation and industrial digitalisation.

The Business

TeamViewer’s software provides remote access and support for IT devices such as computers, mobile phones and tablets, as well as for operation technology (OT) devices such as industrial equipment, robots and medical and other devices.

Sales come from different channels, mainly its own web shop for smaller customers, the inside sales department for the acquisition of larger customers and it also relies on technology partners and strategic sales partners (SAP, Microsoft, Google and Siemens).

Geographically, more than half of its revenues come from the EMEA region, with one third coming from the Americas and the remaining 10% from the APAC region.

TeamViewer is divided into two different segments depending on the ticket paid by the customer and the offering of the software platform.

Small and Medium-Sized Businesses (SMB) Division

The SMB division encompasses customers that spend less than €10,000 per year. It is clealy the larger division of the company generating 78% of its revenues as of Q3 2024. Since the COVID pandemic finished the revenue growth in the division has been sluggish (just 3% in the last 12 months to Q3 2024) and it has strong competitors like Anydesk or ConnectWise ScreenConnect.

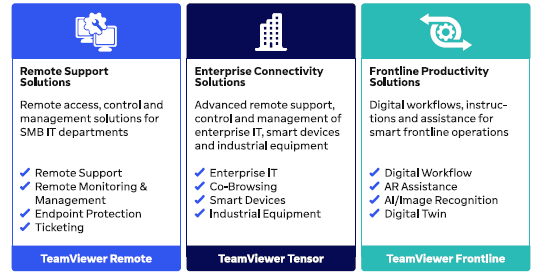

The customer profile are individuals and smaller firms and they use the TeamViewer Remote platform, which can be seen as the entry level and more basic software of the company: it just offers remote access and some control and management solutions for small IT departments.

Enterprise Division

The smaller division of the company with just 22% of the revenues, it’s growing at more than 20% per year. It has around 4,500 enterprise customers that spend more than 10,000€ per year.

Mangement sees this division as the focal point for the future: it has a lot to gain from the digital transformation of the industrial sector and the barriers to entry are way higher than in the SMB division. As such, it has grown from just 12% of revenues in 2020 to 22% in Q3 2024.

The Enterprise segment is aimed at large multinational companies through two different platforms: TeamViewer Tensor, which offers enterprise connectivity solutions, and TeamViewer Frontline for frontline productivity solutions.

TeamViewer Tensor is a more advanced remote connectivity software for large companies that also provides co-browsing and connectivity for industrial equipment and smart devices. Tensor is tailored to corporate customers and provides an overview of the companies’ IT and OT (Operational Technology) device landscapes and simplifies monitoring, maintenance and support.

TeamViewer Frontline is a platform that connects people, machines, devices, and the systems used in a production or logitics process. The platform was created after the acquisition of Ubimax and its offering has been reinforced with subsequent acquisitions in the area. Frontline is the most advanced platform were new tech trends like IoT, AR/MR and AI merge to support customers in their processes.

This is the area with higher growth potential: the Total Addressable Market (TAM) for AR/MR/VR is expected to reach $521B in 2031 (it was just $42B in 2023), an espectacular CAGR of 39.1% in eight years.

Unfortunately, management doesn’t share the split between the two enterprise platforms or its margins so it’s impossible to know the performance of each of them individually.

The Acquisitions

Over these years TeamViewer has acquired several businesses to reinforce its main offering and extend into new areas:

Ubimax - acquired in 2020 for €138M (€86M in cash and €52M in shares) with just €9.1M in revenue, paying a multiple of 15.17x revenues. Ubimax business was centered on digitalizing industrial processes, using its IoT, augmented reality (AR) and frontline solutions. Its Ubimax Frontline platform is now TeamViewer Frontline, part of the Enterprise division.

Xaleon - its core product was a co-browsing technology that was integrated into TeamViewer Tensor. There were no many details about the acquisiton price, only that it was in the low double-digit million range.

Upskill - a US company in the AR sector, it was integrated into TeamViewer Frontline. Its technology was based on the use of smart glasses and handheld mobile devices to support workers in industrial manufacturing, inspection and audit.

Viscopic - a german expert in 3D and mixed reality (MR) solutions for vocational training and professional development of frontline workers. It was another acquisiton with no information about the amount paid; now it’s part ot the TeamViewer Frontline platform.

Picavi - German company that offered and AR-based warehouse picking solution, consisting of smart glasses and a communication module which could be integrated with warehouse systems. As previous acquisitions, no details were given about the price paid and it was integrated into TeamViewer Frontline.

1E - the most recent acquisition and the one that completely changes the scope of Teamviewer. 1E is a software company specializing in Digital Employee Experience (DEX).

The Numbers

Going straight to the financials, TeamViewer shows the typical characteristics of a SaaS business like high margins and high cash conversion, but without the revenue growth.

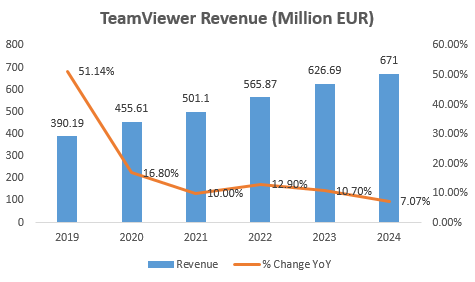

Revenue growth has dipped below below 10% for the first time, which is no bueno for a company that should be viewed as a tech disruptor. As we’ve seen before, the SMB division is the guilty one here while Enterprise growth is quite strong.

It’s true that some of this increase in Enterprise comes from former SMB clients that have upgraded their subscription (€6.4M LTM to Q3 2024, almost 30% of the revenue growth in Enterprise). This effect reduces the revenues of SMB and raises the performance of Enterprise, which is positive overall for the company.

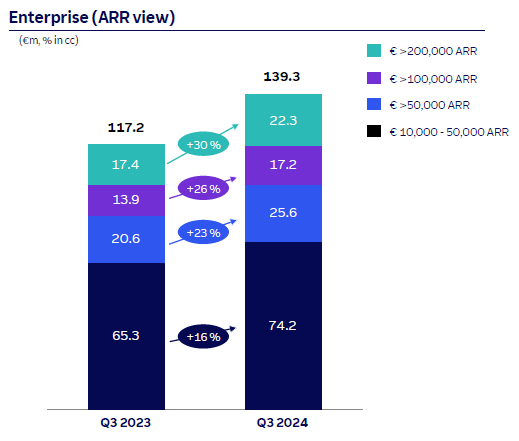

Not only is Enterprise growing much faster than SMB, but the revenue growth accelerates at every level the higher you go up the revenue ladder.

The higher revenue growth (30%) comes from customers that spend more than €200,000 per year, almost doubling the customers in the lower €10,000-50,000 bracket (16%).

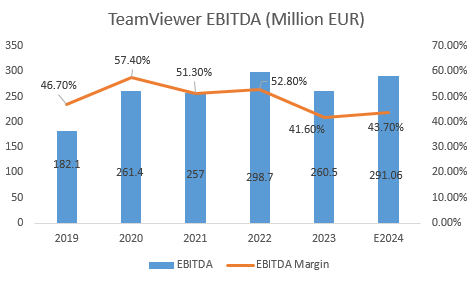

While the slowing revenue growth might be an issue for some investors, its profitability is on par with the trendy US tech stocks: since its IPO it has delivered EBITDA margins comfortably over 40%.

We can see the pump in margins in the pandemic years (2020-2022) where EBITDA margins surpassed the 50%, coming back to the mid 40s% once the situation normalized.

What’s even better, cash conversion is very high, around 70%-80% of EBITDA and quite constant in the 35% area from sales. To reiterate, these are the kind of margins that most companies would kill for.

This high cash generation is what has allowed the company to make acquisitions, buyback stock and even waste money in sport sponsorships and maitain a low net leverage ratio (1.33x Net Debt/EBITDA).

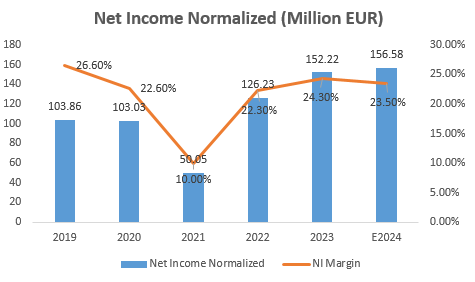

Net Income follows the same trend, with a margin comfortably north of 20%; 2021 was the only year where it was lower due to an increase in marketing costs.

All in all, although revenue growth is a black spot, we can conclude that the company boasts strong financials and top-class margins.

The Problems

The first obvious problem for TeamViewer is that its traditional business model centered around SMBs looks exhausted. Two clear signals back it up:

Revenues are slowing down - In the last year, annual recurring revenue growth at constant currency in the SMB division is just 4%, with negative billings growth in the same time frame.

Net Retention Rate is sitting now at 98% - Net Retention Rate (NRR) is a key metric for a SaaS business because it calculates the percentage of revenue retained from existing customers including upgrades, downgrades, cross-selling and cancelations. If NRR is below 100% it means that the company is losing customers or that its existing customers are spending less.

In the last 12 months the NRR for the whole company has fallen from 100% to 98% but at the same time the NRR of Enterprise has improved (from 94% in Q4 2023 to 99% in Q3 20024), which means that the NRR in SMB is falling like a rock.

The silver linings is that in both cases the issues are isolated in SMB: Enterprise revenue growth is above 20% in the last year and its NRR is improving.

The second problem, which is tied to the first one, is that investors sense that the company lacks direction and a clear roadmap for the future. Management has been unable to paint a clear picture to attract investors.

Cash has been used in several ways with no cohesive argument between them like the acquisition of AR companies at sky-high valuations, the moronic Manchester United sponsorship deal or the share buybacks.

While individually there could be some good decisions, from the outside it looks like management is just throwing things at the wall to see what sticks. Investors are not stupid and can sense when a management team is all over the place with no clear path forward.

But this lack of direction could be come to the end thanks to its last acquisition.

1E Acquisition

On December 10th 2024 TeamViewer announced the acquisition of 1E, a british company leader in Digital Workplace Management (DEX) for $720M (around €686M), impliying an Annual Revenue Multiple of 9.2x for September 2024 and around 8x for 2025. DEX platforms deliver real-time visibility on enterprise IT landscapes, identifying issues as they arise and automating remediation directly on the endpoint, thus minimizing downtime, disruptions and costs.

Having done smaller M&A operations during the last years, this is the first transformational acquisition since the IPO: not only for the price paid (around 3 years worth of TeamViewer’s FCF), but also because it will change TeamViewer offer to create and end-to-end offering for tackling IT issues, from remote support to proactive auto-remediation capabilities.

To reinforce the importance of the acquisition, Mark Banfield, CEO of 1E, will join Teamviewer as Chief Commercial Officer (CCO) and the current Chief Marketing Officer (CMO) of 1E, Stephen Tarleton, will join TeamViewer in the same role.

Going to the financials, in the last 12 months 1E’s revenues have grown 26% to $77M (90% revenue comes from subscription, 9% from maintenance and the rest from consulting) with a 26% adjusted EBITDA margin. The lower EBITDA margin is expected to reduce TeamViewer’s margin to 43% in 2025 before jumping back to 44% in 2026.

Due to the high price paid, Net Leverage ratio will rise to 3.3x after the closing and it is expected to come down below 2.0x by the end of 2026.

For me it’s really difficult to give an opinion because I am not an expert in tech/software. Even so, there are clerly some benefits from the acquisition:

Exposure to North America - right now more than half of TeamViewer revenues come from EMEA, with just around one third coming from the Americas. After the acquisition the proportion will be more balanced and it will offer a strong base to grow from in North America.

Revenue growth - now that revenues in the SMB segment are stagnant, the double digit revenue growth rate that 1E has delivered in the last years will add around 3pp to revenue growth in the mid-term.

Growth in Enterprise - almost the totality of revenues of 1E come from Enterprise clients, which alings with management strategy to grow in this segment. Combining both companies, the share of revenue of Enterprise customers will jump to 28.5% from 22% currently.

High ARR ticket - With an average ticket size of $328,000, the average revenue of 1E per customer is in the top range of TeamViewer’s current Enterprise customers.

Net Retention Rate well over 100% - 1E has a high NRR of 113%, which means that existing customers value its platform and are ready to upgrade its subscription plan. As previously seen, TeamViewer current NRR is below 100% so the acquisition will provide a very needed bump to this metric.

Complimentary products - it will create cross-selling opportunities between customers of both platforms; management expects revenue synergies of €10M in 2026 and €25M in 2027.

Focus - As I have stated before, one of the main problems of TeamViewer is that management has been unable to present a path forward for investors to believe in. With this transformational operation, the path in now clear: the focus will be on the integration of 1E with no time for other skirmishes.

The announcement was not well received by the market, with a drop of 12% on the day, probably because of the high multiple paid. There are some voices that are critical of the acquisition because 1E mostly sells its product via ServiceNow, which just launched its own DEX platform. If this is the case, the large selling effort will lay now into TeamViewer’s inside sales team.

The Management

As I have stated before, I think management has been a drag on TeamViewer’s performance.

First of all, the aforementioned lack of vision from the top about the future of the company.

Secondly, they’ve been very far from achieving their own targets. In the last strategy update in March 2021, management released some targets for the medium term and some years later it has been stated that none of them have been achieved.

€1B in billings in 2023 - FAIL (not even close)

Revenue growth of 25% per annum after 2023 - FAIL (by a lot)

Adjusted EBITDA Margin >50% and increasing from 2024 - FAIL (nowhere near)

€150M incremental billings in 2025 thanks to the Manchester United and Mercedes AMG F1 Team sponsorships - FAIL (no comment)

Unsurprisingly there has not been another strategic plan since then.

Thirdly, lack of transparency. I hate when management doesn’t share info about acquisitions, even if they are small, or there’s no clear info about the business. In both cases TeamViewer’s management is guilty.

It would be very appreciated by the market if they would share the performance of each platform separately (revenues and margins), in order to be able to better value the company. Also, there’s a high need of a new strategic plan to show how 1E is going to be integrated, potential expansion opportunities, where is cash flow going to be deployed, etc. I think it will also be highly welcomed by the market as investors would have a guide for the medium term, something that’s been lacking in the past 4 years.

Lastly, the share buyback programs. Management has been aggresively buying back stock since 2022, reducing the share count from 200 million shares to 170 million shares now, with approximately 12.5 million more that are held as treasury shares. That means that they’ve cancelled 15% of the original share count and have another 7.35% on treasury shares.

I’m a big fan of share buybacks when the valuations are low like in this case. However, for growth investors the rationale is very different: if you are supposed to be a growth company, cash should be invested in growing the business organically or in acquiring companies that have some tech capabilities that you can integrate into the business. When a supposed tech disruptor makes this kind of aggresive buybacks, most investors assume that organic growth is over and it’s better to look elsewhere.

The Share Price

In the case of the share price, it has experienced three very different periods in its short history.

The Boom (Sept 2019 - March 2021) - the beggining of TeamViewer as a public company couldn’t have been better: less than 6 months after the IPO, almost the entire world entered into the COVID lockdowns, making its software critical for most companies. In this time frame the stock price doubled from its high IPO valuation crossing the 50€ mark, and it hovered over the 40€ for almost a year. This period officially ended when the Manchester United deal was announced.

The Fall (March 2021 - December 2021) - once the lockdowns were lifted and the tailwind from the pandemic was over, it was time to show that TeamViewer could keep delivering. And it failed. The stock lost 3/4 of its value in just 9 months from March to December 2021.

The Now What (December 2021 - Present) - since then it’s been more than 3 years that the stock has been trading in a lethargic range (8€-17€) well below the IPO price, with no clear signs of improvement. At the present time the stock is trading at €10.38 , near the bottom of the range.

Overall the stock performance has been abysmal: if you had bought at IPO you would have lost more than half of your investment (-58.4% or -15.3% CAGR) and if you had bought at the top you would have experienced a 80% value drop. The performance is even worse when you realise that there have been no dividends issued, that buybacks amount to more than 20% of the original float and that in the same timeframe most tech/software stocks have skyrocketed.

Valuation

TeamViewer stock is currently trading at €10.38 per share (closing price on January 14th), which implies Market Capitalization of €1.585B and a Total Enterprise Value of €2.021B.

As I always like to point out, I don’t feel comfortable using a DCF method due to the many assumptions you have to make in several parameters (cash flow growth, discount rates, terminal value) which are almost impossible to foresee several years into the future. In the case of TeamViewer we have another source of uncertainty because the 1E acquisition completely changes the financials of the company.

Anyway, I’m going to use the current analyst’s estimates (which don’t take into account the 1E acquisition) to try to give an accurate valuation of the company. Also I am going to be more conservative than management concerning growth prospects, because we have seen that they haven’t been very accurate in the past, to say the least. If management guidance finally materialises in the future, it will give us further upside potential.

Lastly, I will keep the share count stable into the future. Although management has been aggresively buying back stock in the last three years, I think the recent acquisition of 1E greatly increases the net leverage of the company and management will choose to delevarage instead of buying back shares, at least until the end of 2026 when the net leverage ratio will be back under 2.0x.

P/E Ratio Valuation

First of all we have to calculate the EPS for the next years taking into account the 1E acquisition. Hence, I am going to add 75% of 1E’s expected revenues in 2025 (because the operation is expected to close in Q1 2025) to TeamViewer’s stand-alone 2025 analysts expected revenues. For 2026 and 2027 I will just increase total revenue by a conservative 6%. I am going to reduce net income margin expectations to 20% in 2025, 21% in 2026 and 22% in 2027 to take into account a higher interest expense and potential integration costs.

2024e Normalized EPS = €0.97 —> 2024 Norm P/E ratio = 10.38 / 0.97 = 10.70x

2025e Normalized EPS = €0.89 —> 2025 Norm P/E ratio = 10.38 / 0.89 =11.76x

2026e Normalized EPS = €0.97 —> 2026 Norm P/E ratio = 10.38 / 0.97 = 11.20x

2027e Normalized EPS = €1.13 —> 2027 Norm P/E ratio = 10.38 / 1.13 = 9.19x

As always, it is quite difficult to choose the right multiple, but in TeamViewer’s case I think it deserves a multiple in the 15x-20x range due to the quality of the business. On that assumption we would have at least a 40% upside potential, as the stock should be trading on the €14.55-€19.40 range according to 2024 financials, and should be climbing afterwards.

P/FCF Ratio Valuation

If we use Free Cash Flow instead of normalized earnings the picture is even better. In this case I am going to reduce the FCF margin to a more cautious 32% during 2025, then raise 1pp per year afterwards.

2024e FCF/share = €1.35 —> 2024 P/FCF ratio = 10.38 / 1.35 = 7.68x

2025e FCF/share = €1.43 —> 2025 P/FCF ratio = 10.38 / 1.43 = 7.26x

2026e FCF/share = €1.60 —> 2026 P/FCF ratio = 10.38 / 1.60 = 6.48x

2027e FCF/share = €1.75 —> 2027 P/FCF ratio = 10.38 / 1.75 = 5.93x

If we apply the same 15 multiple, it would mean that the upside potential is almost 100% (€20.25) based on 2024e FCF, with much more upside in future years. It looks like a bargain.

EV/EBITDA Ratio Valuation

First of all, to calculate the Enterprise Value in 2025 I will add the €686M price tag for the acquisition of 1E to the current EV of TeamViewer. Secondly, although management has guided for an EBITDA margin of 43% in 2025, I am going to reduce it even further to 41.5% (just below its lower margin of 41.6% achieved in 2023) and increase it 1pp per year subsequently.

FY 2024e EBITDA = €291.06M —> 2024 EV/EBITDA = 2,021 / 291.06 = 6.88x

FY 2025e EBITDA = €304.11M —> 2025 EV/EBITDA = 2,707 / 304.11 = 8.90x

FY 2026e EBITDA = €339.45M —> 2026 EV/EBITDA = 2,707 / 339.45 = 7.97x

FY 2027e EBITDA = €368.29M —> 2027 EV/EBITDA = 2,707 / 293.81 = 7.35x

The ratio worsens after 2024 due to the increase in EV value after the acquisiton. It is difficult to find the right EV/EBITDA multiple at what it should be trading, but it’s the norm to for software companies to be at least in the 12x-15x range. That would give also a 80-100% potential upside based on 2024 EBITDA.

The Revival?

After slandering management for quite some time and remarking ad nauseam that revenue growth is slowing down in its main division, it is time to point out that TeamViewer is a quality company that is severly undervalued.

What’s to like about TeamViewer? A lot: a leader in a growing market, super strong margins, the Enterprise division is growing revenues at a fast pace, it has AR technology that could come up handy in the near future, the 1E acquisition offers a great opportunity to grow and the valuation is so low that it could double and still be undervalued.

There will be bumps along the way, but I think TeamViewer can become stronger in the coming years as a complete remote-support market platform for its enterprise clients. The revival is very possible and at this price the risk/reward seems very attractive.

Yet, we have to take into account several risks and potential catalysts that could change or accelerate this vision.

Risks

1E Integration Risk - As it always happens with acquisitions, there is a risk that it doesn’t turn out as good as expected. While it looks good on paper, it is by far the largest acquisition in TeamViewer’s short history and one that will change its main offering forever. If it doesn’t go well, things could turn ugly.

Further deterioration of the SMB division - as much as mangement has set it objective in growing the Enterprise segment, the reality is that even after the acquisition of 1E more than 70% of revenues will come from the SMB division, where competition is much higher.

Stronger competition from larger tech companies - TeamViewer is a big fish in a small pond (the remote-support market), but it’s a tiny fish in the ocean of the software/tech world. Some of the megacap companies have their own remote-access software (Chrome Remote Desktop, Apple Remote Desktop…) but it’s very basic at the moment, mainly tailored to individual users. There is a risk that as the market grows, one of the big names decides to enter it with deep pockets which will jeopardize TeamViewer’s leadership position.

Catalysts

Successful integration of 1E - while there are some integration risks in the acquisition of 1E, it’s fair to say that a succesful integration could completely transform TeamViewer. If just 20% of its Enterprise customers (900 out of 4,500) chose to adopt 1E’s software it would translate into an extra €275M in revenue (maintaining the current average $328,000 ticket per client).

AR frenzy - growth/momentum investors nowadays love to push trendy stocks to the moon, as TeamViewer enjoyed during the COVID lockdowns. I wouldn’t rule out that in the near future we could have an AR hysteria: there are some products out there like the Snapchat AR Spectacles or the Meta Orion smart glasses but neither of them are for sale for the wider public. Nevertheless, we know how technology works and a new product could change the industry in the blink of an eye.

Acquisition Target - trading at such a low valuation, I think TeamViewer could be an acquisition target for a larger tech company. Don’t forget that it is by far the market leader and the steady cash flows that produces would payback the potential acquisition in a short period of time.

Change in public perception - the main problem with TeamViewer is that it’s not the disruptor that the growth investor loves, but it doesn’t either tick the boxes for the usually more conservative value investor. Like it or not, nowadays for a stock to blow up it needs to offer a narrative that investors buy into. I think the acquisition of 1E could put TeamViewer back in the radar of growth investors and become trendy again.

Conclusion

TeamViewer is a top-quality business that has been penalised in the last years due to revenue growth slowing down and lack of vision from the top about the future of the company. In spite of that, it is highly profitable and it is the clear leader in a market that should keep expanding in the coming years.

Even better, the company is trading below 8x FCF and the recent acquisition of 1E completely changes the scope of its offer, which could be a very positive development for the future.

TeamViewer still has challenges ahead, but I think it offers a very compelling investment opportunity from a risk/reward perspective.